Managing business finances is one of the most critical responsibilities for any organisation, regardless of size or industry. Accurate bookkeeping ensures compliance, improves cash flow visibility, and supports confident decision-making. As businesses grow and financial transactions become more complex, many owners begin to explore outsourced bookkeeping as a practical and cost-effective alternative to maintaining an in-house finance team.

However, one of the most common questions business owners ask is how outsourced bookkeeping charges are structured and what they actually pay for. Understanding how pricing works helps businesses choose the right support model without overspending or compromising financial accuracy. This guide explains outsourced bookkeeping charges, the factors that influence pricing, and how businesses can evaluate value beyond the numbers.

Outsourced bookkeeping involves engaging an external bookkeeping provider to manage financial records, transactions, and reporting instead of handling these tasks internally. This arrangement allows businesses to access professional expertise without the overhead costs associated with hiring and managing in-house staff.

Outsourced bookkeeping typically includes:

By outsourcing these tasks, businesses gain access to specialised knowledge, modern accounting tools, and scalable services that adapt as the business grows.

Many businesses choose outsourced bookkeeping not only for cost reasons but also for operational efficiency and peace of mind.

Key benefits include:

Outsourcing also reduces the risk of errors caused by outdated systems or limited in-house expertise.

Outsourced bookkeeping charges are typically structured using one of several pricing models. Understanding these models helps businesses compare providers fairly and choose a solution that aligns with their needs.

Some bookkeeping providers charge an hourly rate based on the time spent managing financial tasks. This model is often used for businesses with fluctuating workloads or irregular transaction volumes.

Hourly pricing may suit:

However, hourly pricing can make monthly costs unpredictable if transaction volumes vary significantly.

Fixed monthly pricing offers businesses a consistent fee for a defined scope of services. This model provides clarity and predictability, making budgeting easier.

Fixed packages usually include:

This model is particularly popular with small and medium-sized businesses seeking stable financial management.

Some providers assess pricing based on the complexity of the business rather than hours or transaction counts. Factors such as industry requirements, payroll size, and reporting needs influence the final cost.

Custom pricing is ideal for:

This approach ensures services are aligned with operational demands rather than generic estimates.

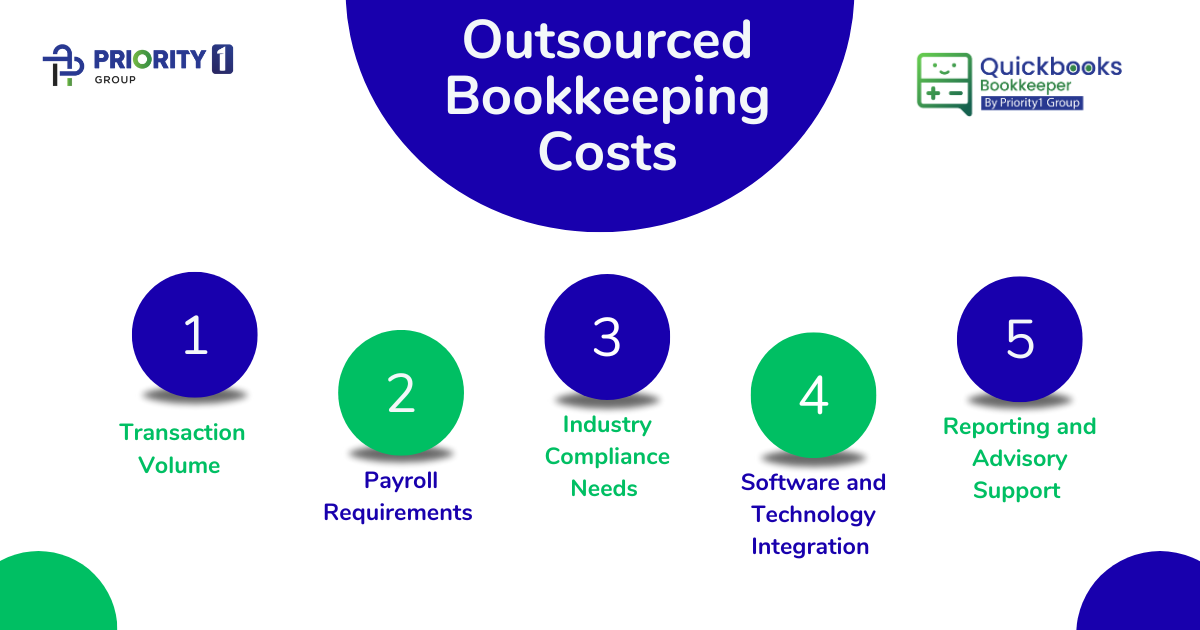

Several factors determine how much a business pays for outsourced bookkeeping services.

Businesses with higher transaction volumes require more processing time, which directly affects pricing. Retail, hospitality, and eCommerce businesses often fall into this category.

Managing payroll, superannuation, and employee entitlements adds complexity. The number of employees and pay cycles significantly impacts service costs.

Industries such as healthcare, NDIS, construction, and legal services require additional compliance checks and reporting, influencing pricing structures.

Businesses using cloud-based platforms benefit from streamlined processes, but setup, migration, and integration can affect initial costs.

Advanced reporting, cash flow forecasting, and management insights may be included as part of premium packages.

While cost is an important consideration, it should not be the only factor when evaluating outsourced bookkeeping services. Value comes from accuracy, reliability, and the ability to support informed decision-making.

High-quality bookkeeping delivers:

Cheaper services that lack structure or expertise can lead to costly errors in the long run.

A detailed breakdown of hourly rates, package structures, and cost trends for bookkeeping services in Australia is outlined in this guide:

This reference provides valuable insight into how bookkeeping pricing is evolving, what businesses should expect in 2026, and how service scope influences overall cost.

For many businesses, outsourcing becomes more economical once transaction volumes and compliance requirements increase.

Outsourcing often costs less than:

Additionally, outsourced providers bring broader expertise that is difficult to replicate with a single in-house hire.

Choosing the cheapest option without understanding service inclusions can lead to poor outcomes.

Businesses often outgrow basic packages quickly, resulting in frequent provider changes.

Not all providers understand industry-specific regulations, increasing compliance risks.

Unclear deliverables often lead to unexpected fees and frustration.

When selecting a bookkeeping provider, businesses should consider:

A structured onboarding process and clear expectations are strong indicators of service quality.

Structured bookkeeping packages designed to suit different business sizes and needs can be viewed here: Our Pricing-Packages of Bookkeeping Services

Understanding outsourced bookkeeping charges empowers businesses to make informed financial decisions and choose services that deliver long-term value. Pricing varies based on transaction volume, compliance requirements, payroll complexity, and reporting needs, but the true value lies in accuracy, reliability, and professional expertise.

Outsourced bookkeeping is not just a cost-saving measure it is a strategic investment in financial clarity and compliance. Businesses that partner with the right provider gain peace of mind, improved cash flow visibility, and the confidence to focus on growth.

QuickBooks Bookkeeper is a part of Priority1 Group and provides professional outsourced bookkeeping services designed to support businesses with accurate, scalable, and compliant financial management.

* We never spam your email

38B Douglas Street, Milton QLD, 4064 Australia

Monday - Friday 09:30 AM - 05:30 PM

© 2026 All Rights Reserved.